Common Terms You Must Know Before Buying Life Insurance

Common Terms You Must Know Before Buying Life Insurance

In buying a life insurance, you could be overwhelmed in all the terminologies that the insurance agent might tell you.

Here are some common terms you need to know so that you will be in the same level of thinking of your agent. And you can even give an impression you’re smart and you REALLY know what she is talking about.

1. PREMIUM – this simply means payment. How much you need to pay. Mode of payment could be monthly, quarterly, semi-annual and annual.

2. POLICY – or policy contract. The contract you will get when you buy a life insurance. There, the coverage, benefits and payment are indicated. All you need to know about your contract is there.

3. MATURITY DATE – the date at which the policy owner can get the face amount. Some matures by age (e.g. age 65) or after certain period of time like 20 years or 15 years. All depends on what you choose.

4. REGULAR PAY – payment until termination of the policy or until maturity of the policy.

5. LIMITED PAY – could be 5 years to pay, 10 years to pay or 15 years to pay. Payment is limited to specific number of years you choose. But coverage could be until lifetime or until maturity of the policy.

6. COVERAGE – the amount your beneficiary gets once you policy owner prematurely dies. In some programs, this is double the face amount.

7. FACE AMOUNT – this could be the same as the coverage, but sometimes in other programs it is not (you need to ask). This is often the basis of computation of premiums.

8. DIVIDENDS – this is the yearly payment the insurance companies pay their policy holders. Meaning, policy holders can earn by dividends. Although these vary annually, could be 1% to 4% depending on the annual investment return of the company and are not guaranteed.

9. RIDERS – these are additional features you like to add to your basic insurance benefits. This entails additional cost to the additional benefits. Some examples of riders are: critical illness rider, accident insurance, disability insurance, hospitalization benefits and waiver of premium when policy holder becomes disable.

10. CONTESTABILITY PERIOD – a short window period wherein insurance companies can investigate and deny claims. This is usually 2 years when policy was enforced. If you die within the contestability period, the company will investigate whether you gave accurate and honest information in your application.

11. INSURANCE CLAIMS – Actual fulfillment of promises of payment of benefits in life insurance. This could be payment of the coverage to beneficiaries in case policy holder dies, or payment of riders to the policy holder. Example could be: payment of particular amount due to critical illness, once policy holder becomes critically ill and it happens the policy has a critical illness rider.

12. BENEFICIARY(ries) – predetermined person/s the policy holder indicated in the application who will benefit to the insurance claims once the policy owner dies before the maturity date. This could be his/her children or spouse or parents.

TRIVIA:

What if you make your “other woman” your beneficiary? — This is usually not allowed and can be contested by the real wife if she finds out.

Buying life insurance is one of the most important thing you can do to yourself and your loved ones. It is a way of showing you love your family. If you think it is just an expense, think of this:

Somebody will need to pay for it; it’s just a matter of who? You, now? Or your Family when you’re gone.

When it comes to planning your future, NOW is always the best time to start.

If people depend on you, life insurance is a must.

But most people have the wrong strategy.

Top 3 Mistakes when buying life insurance

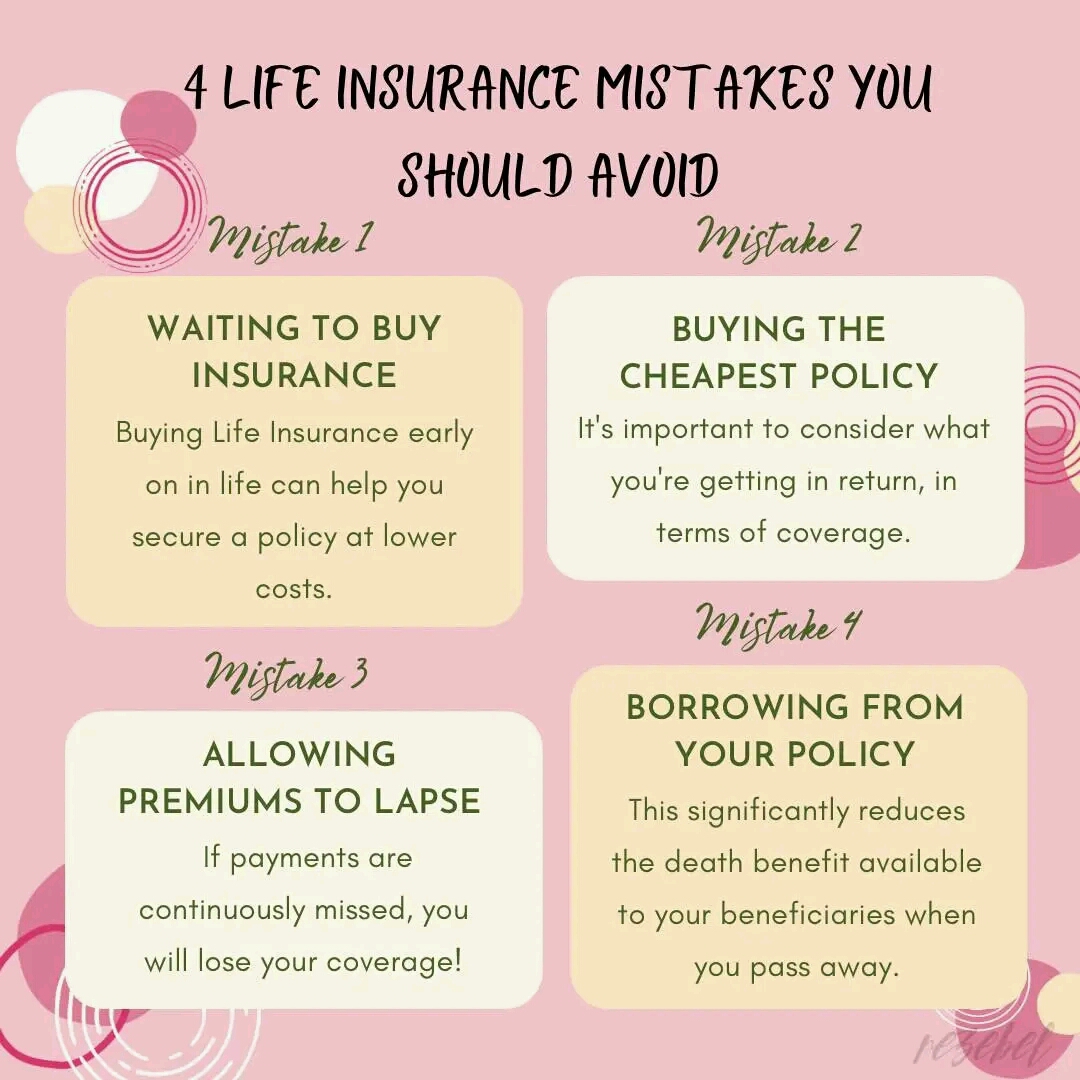

1. Procrastinating on Getting Life Insurance

The number one common mistake when buying life insurance, is waiting too long to get it. Young people often delay getting life insurance UNTIL they have kids later on in their lives. Age is a huge component in determining premiums, typically the younger you are, the more affordable insurance will be.

Procrastinating to get life insurance coverage run the risk of having a critical health condition, which could also make the premiums more expensive.

2. Depending Too Much on Employer Coverage

Many employers offer group life insurance part of their benefits package, but for most employees, it’s just not enough. The death benefit – amount that gets paid out to your beneficiaries – won’t be enough to cover your family needs, if God forbid, something did happen to you.

Another thing with group life insurance, it is not transferable, meaning if you leave that job, you can’t keep the coverage. By the time you do leave your group life policy, you will be years older, maybe even less healthier, which will make it difficult to get an affordable coverage on your own.

3. Being Underinsured

Before buying life insurance you should consider what financial obligations need to be covered, using the DIME method.

Did you know that even high-net-worth individuals don’t have enough life insurance to sustain the families current lifestyle?

Although pension plans, 401k, IRA’s and securities, may be of assistance to a spouse in retirement, those funds may not be available for many years. Life Insurance will fill the retirement gap.

People don’t want to be sold policies, so how can you know what’s right for you?

Talk to an agent who will evaluate and assess your current situation and provide a recommendation that’s not based on a sale.

That will ensure you know how much life insurance fits your needs and exactly how to structure it.

All without a sales agenda.

Conclusion

“Do I need Life Insurance?”

The simple answer is – most likely, yes.

If you have a home or family, having the relevant insurances to protect them is so important.

“You don’t buy life insurance because you are going to die, but because those you love are going to live.”

Make sure your loved ones are protected!

SEE ALSO : Why And How Should I Review My Life Insurance

Hope this post on Common Terms You Must Know Before Buying Life Insurance helps?

Comments are closed.